san francisco sales tax rate 2018

A measure to increase and expand the scope of the local marijuana business tax was on the ballot for San Francisco voters in San Francisco County California on November 6. San Francisco CA Sales Tax Rate.

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

What is the sales tax rate in San Francisco California.

. This is the total of state county and city sales tax rates. For 2018 the Gross Receipts Tax adjustment factor is 100 and the Payroll Expense Tax rate is 0380 000380 after adjustment by the Controller as mandated by law. The statewide California sales tax rate is 725.

The minimum combined sales tax rate for San Francisco California is 85. Then there is a 15 percent state tax on marijuana and a 10 percent. Prior to the election maximum business tax rates on gross receipts in San Francisco ranged from 016 percent to 065 percent.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. For business activities other than retail sales the rate would be 1 percent of gross receipts up to 1 million and 15 percent of gross receipts above 1 million. California sales tax rate.

The California sales tax rate is currently. The San Francisco Office of the Controller City and County of San Francisco. The San Francisco County sales tax rate is.

This is the total of state county and city sales tax. This rate is made up of 600 state sales tax rate and an. Proposition C was designed to increase.

The minimum combined 2022 sales tax rate for San Francisco California is. Arrowbear Lake 7750 San Bernardino Arrowhead Highlands 7750 San Bernardino Arroyo Grande 7750 San Luis Obispo Artesia 9500 Los Angeles Artois 7250 Glenn Arvin. San Geronimo CA Sales Tax Rate.

Tax will continue rather than be phased out after 2018. Historical Tax Rates in California Cities Counties. This is the total of state county and city sales tax rates.

What is the sales tax rate in San Francisco Colorado. San Francisco 8625. The 2018 United States Supreme Court decision in South Dakota v.

San Gabriel CA Sales Tax Rate. This is the total of state county and city sales tax rates. San Fernando CA Sales Tax Rate.

The Basics of California State Sales Tax. Sales and Use Tax Rate through 12-31-16 Sales and Use Tax Rate as of 1-1-17 Gasoline Motor Vehicle Fuel 225. The minimum combined 2022 sales tax rate for South San Francisco California is.

The California sales tax rate is currently 6. The minimum combined 2022 sales tax rate for San Francisco Colorado is 39. The new rates would go into.

There is the regular state sales tax of 6 percent and the regular Alameda County sales tax of 325 percent. San Francisco payroll expense tax rate for 2018 released. The California state sales tax rate is currently.

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

California Sales Tax Rates By City County 2022

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do State And Local Sales Taxes Work Tax Policy Center

Which Cities And States Have The Highest Sales Tax Rates Taxjar

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

How Do State And Local Sales Taxes Work Tax Policy Center

How To Charge Your Customers The Correct Sales Tax Rates

2022 Federal State Payroll Tax Rates For Employers

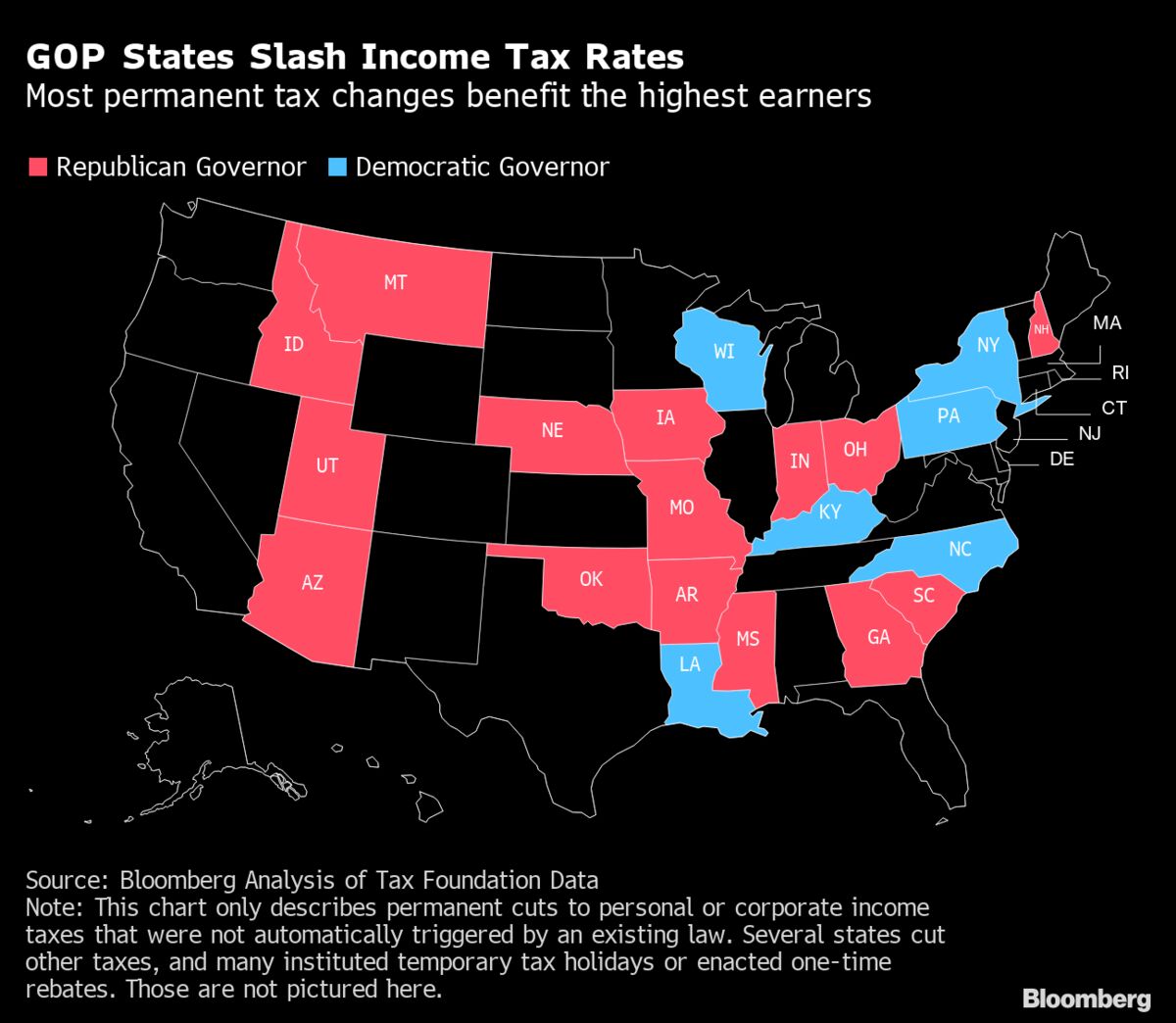

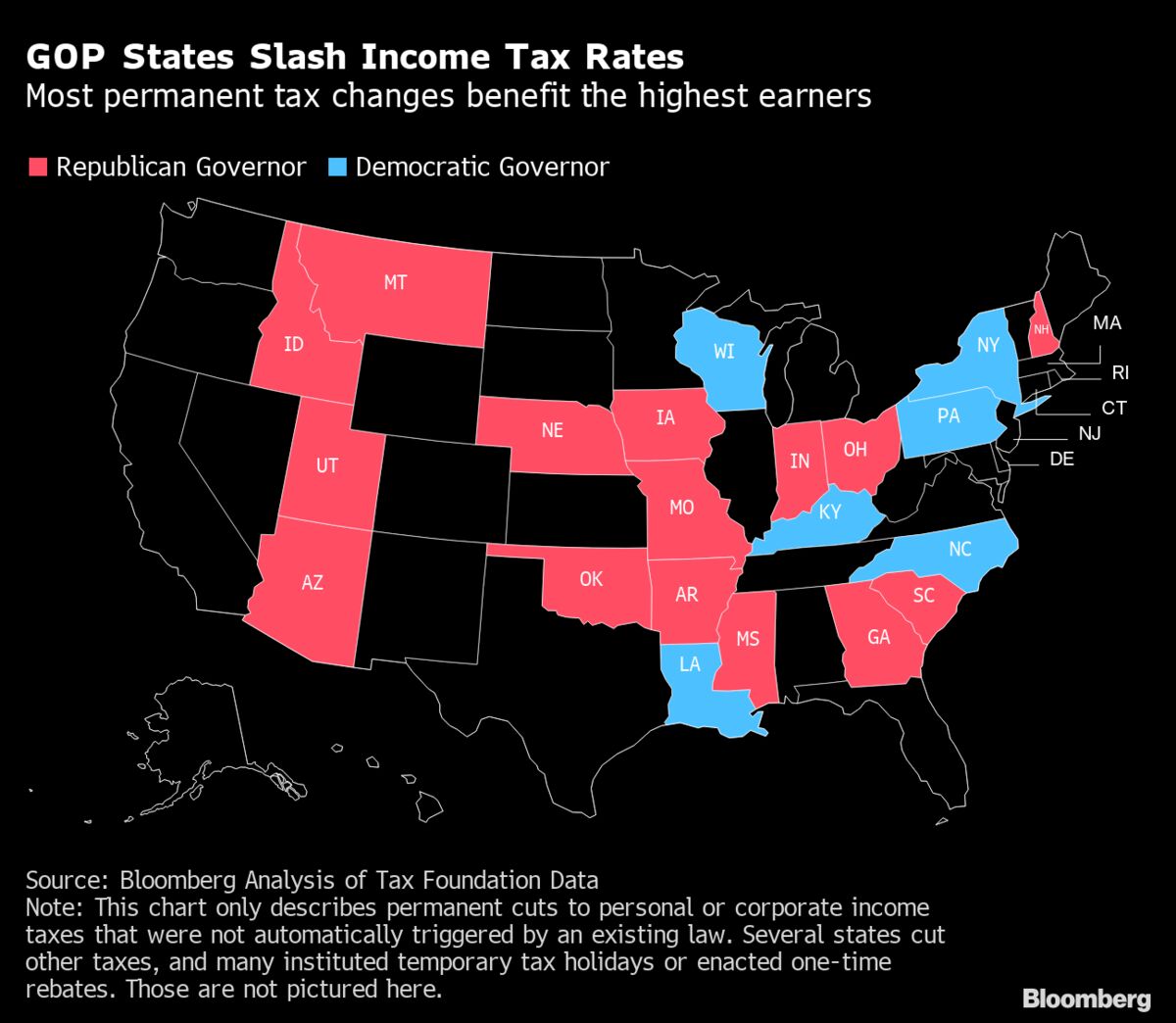

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

California Sales Tax Small Business Guide Truic

How To Calculate Sales Tax In Excel Tutorial Youtube

California City County Sales Use Tax Rates

Bernie Sanders Tax Plans Proposals Tax Foundation

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur